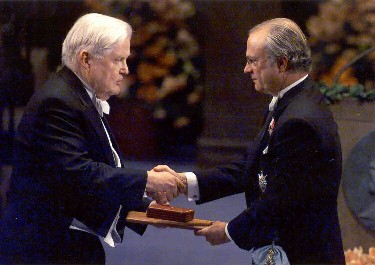

1999

1999Robert A. Mundell (1932-)

Premiu Nobel  1999

1999

Economist canadian. Profesor la Columbia University din New York. A lucrat in principal in domeniul teoriei monetare si al economiei internationale. A obtinut Premiul Nobel "pentru analizele sale asupra politicilor fiscale si monetare din diferite sisteme monetare si analizele sale in ariile optime de devize.".

Este considerat unul dintre teoreticienii monedei unice europene, Euro, si a efectelor macroeconomice ale pietelor de devize.

S-a nascut la Kingston (Canada) si si-a luat doctoratul la doar 24 de ani la Massachussets Institute of Technology (MIT) cu o teza despre miscarile internationale a capitalurilor. A studiat la London School of Economics. Cu timpul, Mundell se transforma in unul din purtatorii de cuvant cei mai eminenti ai influentei scoli de la Chicago, de unde a dezvoltat, in timpul anilor saizeci, teza sa despre rolul politicii monetare si fiscale intr-o economie deschisa. Astazi lucreaza la Universitatea Columbia din New York.

|

Apasati

aici pentru a vedea cartile lui puse in vanzare |

In lucrarea sa, International Economics (1968), Mundell isi dezvolta analiza in forma simpla, dar concluziile sale sunt multiple, solide si clare. Mundell introduce comertul exterior si miscarile capitalurilor in modelul economic inchis. Aceasta analiza ii permite sa arate cum efectele unei politici de stabilizare depinde de gradul de mobilitate al capitalului international. A demonstrat in special rolul esential jucat de sistemul comisioanelor de schimb. Intr-un sistem de comisioane de schimb variabile, politica monetara constituie un instrument eficient, contrar a ceea ce se intampla intr-un sistem fix de comisioane. Tentativele aplicarii politicilor nationale independente apeland la numitele "piete deschise", nu produc niciun rezultat deoarece nici ratele dobanzilor si nici ale celor de schimb nu pot fi schimbate. In mod contrar, cresterea cheltuielilor publice sau alte masuri fiscale permit cresterea activitatii economice si a veniturilor, ce nu pot fi franate de o crestere a ratelor dobanzii sau de o rata de schimb mai mare.

In articolul despre "zonele monetare optime", din 1961, Mundell trece repede in revista avantajele unei monede comune ca baza de cost a tranzactiilor si o reducere a limitei de incertitudine din cadrul preturilor relative, descriind si dezavantajele. Una dintre cele mai importante este ca daca o anumita zona vrea sa-si mentina locurile de munca, trebuie sa-si reduca salariile reale. Mundell semnaleaza importanta unei mari mobilitati a muncii pentru a ascunde numitele "socuri asimetrice". Pentru el, o zona monetara optima este un ansamblu de regiuni cu o inclinatie catre migratiile suficient de mari pentru a asigura oameni in toate domeniile, atunci cand o regiune trebuie sa se confrunte cu "socurile asimetrice".

Lucrari

"International Trade and Factor Mobility", 1957, AER

"Transport Costs in International Trade Theory", 1957, Canadian JE

"The Monetary Dynamics of International Adjustment Under Fixed and Flexible Exchange Rates", 1960, QJE

"The Public Debt, Corporate Income Taxes and the Rate of Interest", 1960, JPE

"The Pure Theory of International Trade", 1960, AER (1968 version: Part 1, Part 2, Part 3)

"The Public Debt, Corporate Income Taxes and the Rate of Interest,"1960, JPE

"A Theory of Optimum Currency Areas", 1961, AER

"Flexible Exchange Rates and Employment Policy," 1961, Canadian JE

"The International Disequilibrium System", 1961, Kyklos

"The Appropriate Use of Monetary and Fiscal Policy for Internal and External Stability", 1962, IMF Staff Papers

"Capital Mobility and Stabilisation Policy under Fixed and Flexible Exchange Rates", 1963, Canadian JE

"Inflation and Real Interest", 1963, JPE

"An Exposition of Some Subtleties in the Keynesian System", 1964, WWA

"Tariff Preferences and the Terms of Trade,"1964, Manchester School

"Growth, Stability and Inflationary Finance", 1965, JPE

"A Fallacy in the Interpretation of Macroeconomic Equilibrium", 1965, JPE

"The Significance of the Homogeneity Postulate for the Laws of Comparative Statics" 1965, Econometrica

The International Monetary System: Conflict and Reform, 1965

"The Crisis Problem" 1967, in Mundell and Soboda, editors, International Monetary Problems

"International Monetary Economics: The Balance of Payments", 1968, IESS

"Hicksian Stability, Currency Markets and the Theory of Economic Policy", 1968, in Wolfe, editor, Value, Capital and Growth

Man and Economics, 1968

International Economics, 1968.

Monetary Theory: interest, inflation and growth in the world economy., 1971.

"The International Distribution of Money in a Growing World Economy", 1971, in Bhagwati et al., editors, Trade, Balance of Payments and Growth

"The Optimum Balance of Payments Deficit and the Theory of Empires." 1971, in Salin and Classen, editors, Stabilization Policies in Interdependent Economies

"Uncommon Arguments for Common Currencies", 1973, in Johnson and Swoboda, editors, Economics of Common Currencies

"A Plan for a European Currency", 1973, in Johnson and Swoboda, editors, Economics of Common Currencies

"The Origins and Evolution of Monetarism.", 1982, in Jansen, editor, Monetarism, Economic Crisis and the Third World.

"The Case for a Managed International Gold Standard."1983 in Connolly, editor, The International Monetary System

"Latin American Debt and the Transfer Problem" 1989, in Brock et al, editors, Latin American Debt and Adjustment .

"The Dollar and the Policy Mix: 1989," 1989 Rivista di Politica Economica

The Global Adjustment System," 1989, Rivista di Politica Economica

"The International Distribution of Saving: Past, Present and Future." 1990, Rivista di Politica Economica

"Debts and Deficits in Alternative Models", 1990, Rivista di Politica Economica

"Fiscal Policy in the Theory of International Trade.", 1992, in Giersch, editor, Money, Trade and Competition

"The Quantity Theory of Money in an Open Economy: Variations on the Hume-Polak Model." , 1992, in International Financial Policy

"Rejection of the Common Funnel Theorem," Rivista di Politica Economica

"Unemployment, Competitiveness and the Welfare State", 1995, Rivista di Politica Economica

"The International Monetary System: The Missing Factor." 1995, Journal of Policy Modeling

"The International Adjustment Mechanism of the Balance of Payments," 1997 Zagreb Journal of Economics

"The Uses and Abuses of Gresham's Law in the History of Money", 1998 Zagreb Journal of Economics

Pagina web personala:

http://www.columbia.edu/~ram15/Home Page of Robert Mundell.htm

Curriculum Vitae

e-mail: ram15@columbia.edu

Daca sunteti conectat la Internet, puteti achizitiona urmatoarea carte

The Euro As a Stabilizer in the International Economic System de Robert Mundell si Armand Clesse (Editori). In aceasta carte se examineaza implicatiile crearii euro in stabilitatea sistemului monetar international. Printre problemele centrale abordate sunt: Este euro o moneda puternica sau slaba? Va fi euro un rival pentru dolarul american? Cum va afecta euro cooperarea dintre Europa si Statele Unite? Este posibil ca euro sa implice un schimb istoric in sistemul economic international?